Wholesaling

Food wholesaling is a component of food marketing in which goods are assembled, stored, and transported to customers, including retailers, food service operators, other wholesalers, government, and other types of businesses.

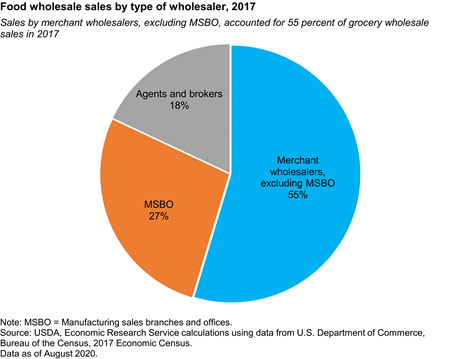

There are three basic types of wholesalers, as classified by the Census Bureau's Economic Census:

- Merchant wholesalers, excluding manufacturing sales branches and offices (MSBO)—also referred to as third-party wholesalers—are primarily engaged in buying groceries and related products from manufacturers or processors, and reselling these products to retailers, institutions, and other businesses. Sales by merchant wholesalers accounted for 55 percent of grocery wholesale sales in 2017, down slightly from 56 percent in 2012.

- MSBOs are merchant wholesale operations maintained by grocery manufacturers to market their own products. The share of grocery wholesale sales accounted for by these establishments increased from 25 percent in 2012 to 27 percent in 2017.

- Brokers and agents are wholesale operators who buy or sell for a commission as representatives of others and typically do not own or physically handle the products.

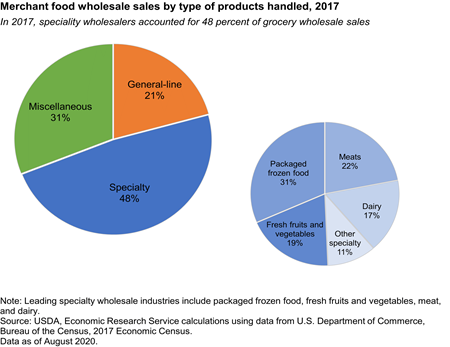

Merchant grocery wholesalers are classified by the Census of Wholesale Trade based on the types of products distributed:

- General-line distributors—also referred to as broadline or full-line distributors—are companies that handle a broad line of food products (for example, C&S Wholesale Grocers, Supervalu, SpartanNash, and Sysco).

- Specialty distributors—companies with operations primarily engaged in the wholesale distribution of items such as frozen foods, dairy products, meat and meat products, or fresh fruits and vegetables. They operate in niche markets where it is necessary to have specialized knowledge about the type of product handled or type of operator served. Specialty wholesalers serve a wide range of niche operators, such as airlines, convenience stores, hotels/motels, and club warehouses. They account for 48 percent of grocery wholesale sales. Leading specialty categories include packaged frozen foods (31 percent of sales by specialty distributors), fresh fruits and vegetables (19 percent), and dairy (17 percent).

- Miscellaneous distributors—companies primarily engaged in the wholesale distribution of a narrow range of dry groceries such as canned foods, coffee, bread, or soft drinks.

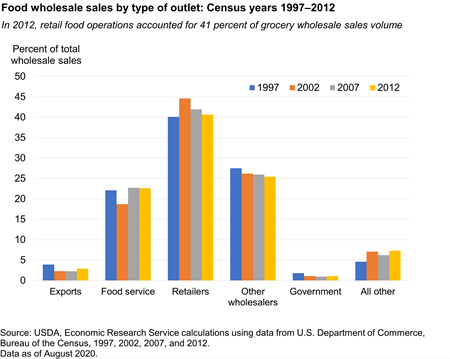

Food wholesaling consists of both retail and food service sales. Some key findings on sales are highlighted below:

- Sales to retail food stores (food-at-home sector) were $405 billion in 2012, the most recent year of data.

- Sales to food service operators (food-away-from-home sector) were $225 billion in 2012.

- Additionally, sales to other wholesalers—small specialty wholesalers who purchase goods from larger wholesalers—were a significant share (25 percent) of total sales.

Several food wholesalers ranked among the largest privately held companies in the U.S. based on sales volume. According to Forbes’ annual rankings of America’s largest private companies, C&S Wholesale Grocers was tenth, Reyes Holdings was number 12, and Gordon Food Service was number 23.

Retail Food Store Wholesalers

Grocery wholesale sales to retail food operations, such as supermarkets and convenience stores, totaled $405 billion in 2012, the most recent year of data, or 41 percent of grocery wholesale sales volume. This is down from 42 percent in 2007 and 45 percent in 2002.

Download chart data in Excel format.

The retail food store wholesaling sector continues to undergo important structural changes. The Nation's ninth largest grocery wholesaler in 2013, Spartan Stores, merged with Nash Finch, which was the largest food wholesaler serving military commissaries and exchanges in the U.S. The combined company was named SpartanNash. In 2014, C&S Wholesale Grocers, the largest grocery wholesaler in the U.S., acquired the warehouse and distribution operations of the eighth largest wholesaler at the time, Grocers Supply. This followed C&S’s acquisition of Associated Wholesalers Inc., the ninth largest U.S. grocery wholesaler earlier in 2014.

As consolidation in food retailing grew, manufacturers and large retailers offering a broad assortment of items have found it advantageous to negotiate directly with each other, reducing the power and influence of traditional wholesalers. Self-distribution is the preferred method of vertical coordination for large grocery chain stores (those with 11 or more stores). A decline in the number of wholesalers leaves smaller independent grocers (those with 1-10 stores) with fewer options for obtaining their merchandise.

Food Service Wholesalers

Restaurants and other food service companies are also major customers of wholesalers. Sales to these firms accounted for $225 billion in 2012, or 23 percent of all sales of groceries and related products by all food wholesalers—the same share of sales as in 2007. While retail grocery outlets and food service companies compete for consumers' food dollars, wholesalers that distribute to the food service industry and to food retail outlets do not compete directly with each other for customers.

Industry analysts define three types of food service distributors:

- Broadline food service distributors—companies that have traditionally purchased a wide range of food products from manufacturers and stocked these goods in one of their distribution centers. Most broadline food service distributors offer value-added services designed to meet the needs of single-store restaurants and small chains (for example, Sysco and US Foods).

- Specialty food service distributors—companies that do not stock a wide range of products; instead, they operate in niche markets where it is often necessary to have specialized knowledge about product sourcing, handling, or service. Market specialists serve a wide range of niche operators, such convenience stores, hotels/motels, and club warehouses.

- System food service distributors—companies that serve a customer base that consists mostly of chain restaurants with centralized purchasing and menu development. Individual operators within chains may not require the value-added services provided by a broadline or specialty distributor, such as obtaining information about new products or assistance in developing and preparing new menu items.

In 2015, Sysco’s planned merger with US Foods (formerly U.S. Foodservice) was dropped after being blocked based on antitrust grounds. Sysco is the largest distributor of grocery items to U.S. food service operations—restaurants, hospitals, cafeterias—based on sales, and US Foods is the second largest food service distributor.