Market Outlook

See the latest Vegetables and Pulses Outlook report.

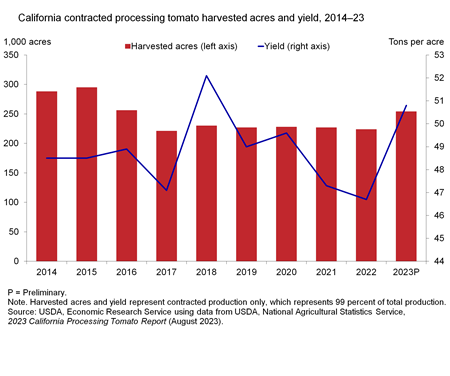

California Processing Tomato Yield Improves in 2023

The United States is the largest processing tomato producer in the world. Each year, California accounts for the majority of processing tomato acres harvested in the United States. Following 2 years that fell short of expectations, California processing tomato yields are forecast to be the second highest yield on record in 2023 (50.8 tons per acre). Despite a delayed start to spring planting, high contract prices and easing drought conditions contributed to a 13 percent increase in harvested acres. In 2023, contracted production is forecast at 12.9 million tons, the largest crop since 2015.

Download chart data in Excel format