U.S. Pork Exports Projected to Surpass Chicken in the Next Decade

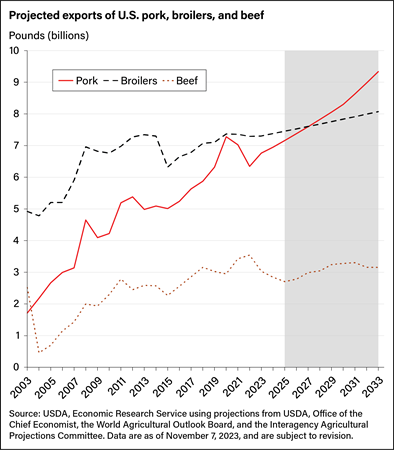

U.S. exports of major meats are projected to grow through 2033, according to USDA long-term (also known as “baseline”) projection data. Rising incomes in other countries and a fractionally declining real exchange rate of the U.S. dollar against the currencies of major agricultural trade partners—although from a relatively high level—are expected to bolster exports of U.S. red meat and poultry products. In the projections, annual pork exports are set to exceed exports of broilers (young chickens) in the latter years of the projection period, the first time that will have happened since 1976.

Beef cattle inventories and, therefore, commercial beef production historically have followed a cycle that lasts an average of 10 years. The current cattle cycle began in 2014, and the U.S. beef cow herd’s present contraction phase—a period of declining inventory—is expected to continue into 2024 and 2025. Beef exports, which are expected at an 8-year low for 2024, are projected to fall further, to 2.71 billion pounds in 2025 (almost 5 percent), before beginning a steady climb through 2031. Still, U.S. beef exports are expected to fall slightly the last 2 years of the projection, reflecting a projected decline in commercial production.

Historically, prices for chicken meat have been lower than for beef and pork, and therefore demand for U.S. broilers has grown. With production rising, steady growth is expected for broiler exports, projected to reach 8.07 billion pounds in 2033. Broiler exports are expected to rise from a record 7.38 billion pounds in 2024 to 7.45 billion pounds in the first year of the projection period and continue to set record highs each year of the projection period, ending 8 percent higher by 2033. Factors influencing U.S. poultry export growth include global income and population growth and urbanization trends in many developing economies and emerging markets.

Steady growth in pork production is driven by a combination of factors, including increasing slaughter weights, rising numbers of pigs-per-litter, and larger inventories. U.S. pork exports are projected to grow from an expected 6.95 billion pounds in 2024 to 9.34 billion pounds by 2033, an increase of more than 34 percent. By 2026, U.S. pork exports are expected to surpass the record of 7.28 billion pounds set in 2020, which was attributed to high pork demand from China at the height of its disruptive African swine fever epidemic. U.S. pork exports, which surpassed beef exports back in 2004, are projected to outpace chicken exports in 2028 and to continue to do so throughout the projection period. Efficiency gains in U.S. hog production and pork processing are expected to continue to enhance the sector’s international competitiveness. In addition, European Union (EU) policies are expected to reduce growth of that region’s pork exports, and the United States is projected to surpass the EU as the world’s leading pork exporter in 2025.

Even with increases in U.S. beef, chicken, and pork exports, production and domestic availability of these meats still is expected to grow faster than their exports. In the United States, per capita domestic consumption of all three meats in 2033 is expected to exceed 2024 levels. Of the three meats, per capita pork consumption is projected to increase by the smallest amount (1.7 pounds), peaking in 2030 at 53.6 pounds before starting to fall near the end of the projection period to 52.7 pounds by 2033. Per capita consumption of beef is forecast at the lowest level in 9 years for 2024 but is projected to increase 2.6 pounds by the end of the projection period. Per capita broiler consumption is projected to grow 7.3 pounds. Domestic per capita meat consumption is driven by continued income growth among consumers as well as an ongoing preference for animal proteins.

Agricultural Baseline Database, by Baseline Team, USDA, Economic Research Service, March 2024

Hogs & Pork, by Mildred Haley, USDA, Economic Research Service, January 2024

Poultry & Eggs, by Grace Grossen, USDA, Economic Research Service, October 2023

Cattle & Beef, by Russell Knight, USDA, Economic Research Service, August 2023