Food Policy and Productivity Key to India Outlook

Highlights:

-

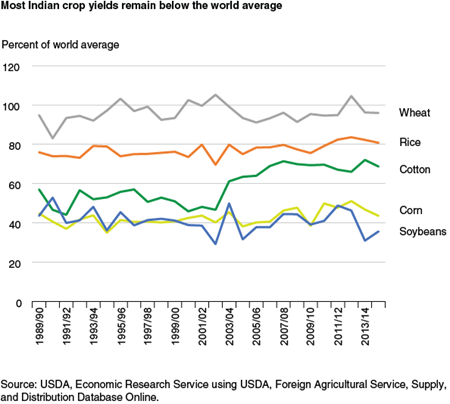

India’s farm sector growth has strengthened in the last decade, but yields of major crops remain low despite a rich endowment of soil and water resources.

-

Large surpluses of staple cereals alongside persistent calorie deficits are increasing pressures to change agricultural and food policies by India’s new Government, creating uncertainty in the 10-year outlook.

-

India is likely to remain an important player in global markets as an importer of vegetable oils and pulses, and an exporter of rice, cotton, and beef.

As the two largest and fastest-growing developing countries, India and China are generally identified as sources of growth in global agricultural demand and trade. While China has emerged as a large and fast-growing market since 2000, growth in Indian demand and trade, while strong, has been less significant for U.S. and global markets. Similar to China, economic growth is likely to drive changes in Indian food demand over the next decade, with the trade outcomes shaped by productivity gains in the farm sector and the evolution of India’s domestic farm and trade policies. Average real GDP growth of about 7.1 percent since 2000 has made India the second fastest-growing large economy during this period, after China. Aided by continued gradual slowing of population growth, per capita gross national income in current U.S. dollars reached $1,570 in 2013, still well below China’s $6,560, but classifying India as a lower middle-income country. Global economic recovery in the near term, relatively low world crude oil prices, and fiscal and investment reforms in India are expected to push India’s economic growth rate above China’s by the late 2010s, to an average of 7.5 percent during the next decade.

Rising incomes, further urbanization (the population was about 68 percent rural in 2013), and India’s youthful demographic profile are expected to shape continued growth and increased diversity in consumer food demand. While per capita consumption of staple grains—rice and wheat—has been relatively stable since 2000, demand for higher valued foods—such as fruits, vegetables, edible oils, dairy products, and poultry meats—has been robust. Offsetting some of this growth story, however, is that Government estimates indicate that about 22 percent of India’s population—or about 260 million people—remain in poverty. According to USDA estimates, India still accounts for the largest share of the global population classified as food insecure.

While the outlook for growth in food demand appears to be robust and sustainable, India’s limited progress in improving crop yields, along with ongoing pressures to reform costly farm policies and strengthen farm sector investment, represents two of the key uncertainties in India’s trade outlook. Researchers describe the analysis and assumptions on these issues incorporated in the India projections included in USDA Agricultural Projections to 2024. These projections for global and U.S. agriculture are a USDA interagency product based on a combination of model results and analyst judgment that are updated annually.

Big Resources, Low Yields

India’s large and diverse agricultural sector is growing more rapidly than it was a decade ago, but per hectare yields of major crops (except wheat, which is 93 percent irrigated) remain low by world standards. According to India’s Commission on Agricultural Costs and Prices, the large gaps between national average yields and those achieved in the highest yielding Indian states, ranging from 32 percent for wheat to 48 percent for corn, are indicative of the potential to achieve higher national average yields. Low yields persist despite generally good quality soils; ample, if highly seasonal, rainfall; and the largest irrigated area in the world. Counting land that is sown more than once, India sows crops on an average of 194 million hectares (one hectare equals 2.471 acres) annually, with about 88 million hectares—or 45 percent—irrigated. Total irrigated area is expanding at about 1.0 million hectares annually.

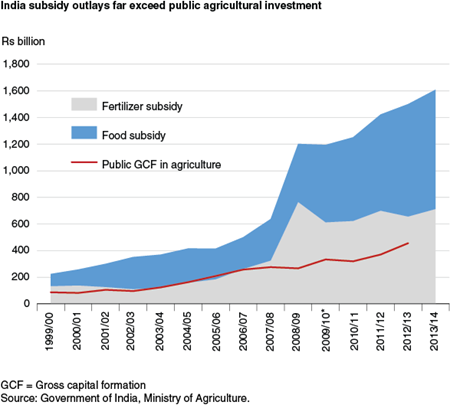

Low yields also persist despite large and generally growing Government outlays on input subsidies, particularly for fertilizer and electricity, which is widely used to pump groundwater for irrigation. India’s small scale-farm holdings—the average operational holding is 1.15 hectares—are often cited as a reason for the slow or limited adoption of technology. However it is not clear that farm structure is an overriding constraint on technology adoption; in China, the average farm size is about half that in India, while average yields of most major crops are significantly higher.

Another possible factor behind the low yields is the relatively low levels of investment in agriculture, including research, extension, and market infrastructure. Despite growing and diversifying food demand, public investment in agriculture has remained flat at about 3 percent of agricultural GDP since 2000. This trend is in sharp contrast to outlays for input subsidies, which now far exceed public investments. Private investment in Indian agriculture is much larger than public investment and is rising, and a number of notable recent productivity advances can be traced to private investment. These include the development and adoption of hybrid Bt (bacillus thuringiensis) cotton varieties and hybrid corn, the rapid growth of integrated poultry operations, and the still nascent development of modern food marketing and supply chains. However, private investment in agriculture is growing at a significantly slower rate than private investment in the overall economy and is likely impeded by a range of central and state government regulations that add to the cost and risk of private agribusiness investment.

Current USDA long-term projections for India show a continued gradual increase in major crop yields towards potential yields, represented by those achieved in high-yielding states. Other than Bt cotton, now planted on about 92 percent of India’s cotton area, no further approvals of genetically modified (GM) crops are assumed. Given India’s relatively strong agricultural resource base and low average yields, with greater public and private investment, yields could potentially grow faster.

Policy Reform Uncertain

Although India’s agricultural sector is growing more rapidly than it was a decade ago, it is doing so in the context of rising subsidy outlays, frequent bursts of food price inflation, and the persistent undernourishment of a large share of the population. A new Government, elected in 2014 with the first single-party parliamentary majority since 1984, has moved cautiously on farm sector reform. Processes that could lead to significant changes in the management of India’s food grain economy, consumer food subsidies, and incentives for private investment have been set in motion. However, even with the electoral mandate, Indian farm policymakers continue to face a difficult environment for enacting reform. They face an active electorate that is often directly affected by changes in farm income or consumer food prices, and a constitution that leaves most agricultural policy decisions to State governments with a diverse array of priorities.

The new national Government is initially focusing on the food grain economy, specifically rice and wheat. The costs of price support, procurement, subsidized distribution, and stockholding are increasingly burdensome, while grower benefits are limited to a few regions and consumer benefits are sapped by large-scale inefficiencies. Some measures under consideration include breaking up and shrinking the role of the Food Corporation of India (FCI), the government entity that handles procurement, movement, and storage operations; and implementing the National Food Security Act (NFSA), a broadened food subsidy program enacted by the previous Government. No major policy changes have become explicit so far, but recent developments provide a hint at future policy direction. Recent increases in Minimum Support Prices (MSPs) have been moderated in light of large stock surpluses, the FCI is shifting its focus from surplus states to areas where price supports have not always been effective, and the NFSA has been implemented in some states.

Perhaps the most intriguing policy development, with potentially large implications for the future of Indian agricultural policy, is the progress being made to create the administrative capacity to shift away from reliance on price subsidies to supporting producers and consumers through cash transfers. Until now, tools available to Indian policymakers have been restricted to a few, relatively market distorting policy instruments: MSPs supported in some areas by physical purchases, physical distribution of subsidized grain, subsidized administered prices for inputs, and tariff and nontariff trade measures. India’s Government is now implementing initiatives that are expected to enable the administration of less costly, better targeted, and less market-distorting cash transfers. These initiatives include expanding access to bank accounts and issuing biometric identification cards to all citizens. These steps, combined with the rapid increase in cell phone ownership and cell phone-based applications, are expected to provide the tools to eventually re-instrument Indian policies. About 750 million Indians now have biometric identification cards issued through the “Aadhaar” program, with 20 million new cards issued each month. India now has about 600 million unique cell phone users, including about 370 million in rural areas.

Food Grain Surpluses Projected to Decline

Establishing the political consensus and administrative capacity for significant policy change is likely to be a gradual process that moves faster in some states than others, with uncertain market impacts over the next decade. The policy assumptions underlying the current USDA long-term projections for Indian food grains are based on relatively minor impacts from policy reforms over the next decade. Key assumptions are:

- Price support policy is most relevant for wheat and rice. Price supports are adjusted only nominally in early years in response to current conditions of relatively high stocks and low world prices, then return to trend.

- Input subsidies continue consistent with recent trends, although lower energy prices moderate the cost of the fertilizer subsidy in the medium term.

- Even with implementation of the NFSA, the quantity of wheat and rice distributed remains close to recent historical trends, with the major impact being the lower subsidized consumer price called for under the NFSA.

- Private exports of rice and wheat continue without government restriction as market conditions permit.

- Applied rice and wheat import tariffs remain at zero.

Under these assumptions, growth in production of both wheat and rice is expected to slow from the pace achieved during 2000-2012. With gains in incomes driving diet diversification, growth in consumption of both staples is expected to continue to slow, as it has for the last several decades. Exports of rice and wheat are also expected to decline from recent averages, although India is likely to remain among the world’s top three rice exporters. Indian corn production accelerated during 2000-12 in response to rising domestic feed demand, import demand in nearby markets, and the adoption of hybrid corn varieties. Although domestic feed demand, particularly from the poultry industry, is expected to remain robust, the outlook for lower global corn prices leads to slower projected growth in corn production and reduced exports.

India Projected to Remain Largest Edible Oil Importer

India emerged as a major vegetable oil importer in the 1990s as domestic demand outstripped domestic production of edible oils derived from a range of oil crops, including soybeans, rapeseed, peanuts, and sunflowerseed. Oilseed production is generally less profitable than competing cereal and cotton crops and is mostly relegated to less productive rainfed areas. Slow production growth is projected to continue, with little improvement in chronically low yields. Soybean area and production have been supported by domestic and foreign demand for soybean meal and domestic oil demand, but there has been negligible improvement in yields, and prospects for continued area growth appear limited.

India’s imports of edible oils—now the largest in the world—have been subject to relatively low tariffs since the mid-2000s, with tariffs now set at 2.5 percent for crude oils and 10 percent for refined oils. These tariffs are assumed to gradually double over the next decade, reflecting ongoing pressure from domestic oil millers. Under this assumption, vegetable oil imports are projected to continue to expand, reaching more than 18 million tons annually by 2024/25. The composition of imports is price sensitive and tends to favor palm oil over generally more expensive soybean and rapeseed oil, a pattern that is projected to continue over the next decade.

| 2011/12–2013/14 average (million tons) | 2024/25 (million tons) | Growth rate: 2000–12 (annual percent change) | Growth rate: 2012–2024 (annual percent change) | |

|---|---|---|---|---|

| Rice | ||||

| Production | 105.7 | 113.3 | 1.4 | 0.6 |

| Consumption | 95.5 | 105.0 | 1.3 | 0.8 |

| Exports | 10.5 | 8.3 | 10.6 | -2.0 |

| Wheat | ||||

| Production | 91.8 | 103.1 | 2.0 | 1.0 |

| Consumption | 86.4 | 100.4 | 2.2 | 1.3 |

| Exports | 4.5 | 2.5 | 9.0 | -4.9 |

| Corn | ||||

| Production | 22.7 | 30.7 | 5.3 | 2.5 |

| Consumption | 18.1 | 29.2 | 3.5 | 4.1 |

| Exports | 4.4 | 1.4 | 46.3 | -8.9 |

| Cotton | ||||

| Production | 6.4 | 8.3 | 7.9 | 2.2 |

| Consumption | 4.7 | 6.4 | 4.0 | 2.6 |

| Exports | 2.0 | 2.1 | 49.8 | 0.2 |

| Imports | 0.2 | 0.1 | -6.3 | -3.6 |

| Soybeans | ||||

| Production | 11.2 | 13.8 | 6.4 | 1.8 |

| Consumption | 11.0 | 13.7 | 6.5 | 1.9 |

| Vegetable oil | ||||

| Production | 7.1 | 8.4 | 2.4 | 1.4 |

| Consumption | 17.9 | 26.8 | 4.4 | 3.4 |

| Imports | 10.8 | 18.4 | 6.1 | 4.5 |

| Poultry | ||||

| Production | 3.4 | 7.2 | 8.9 | 6.3 |

| Consumption | 3.4 | 7.2 | 8.8 | 6.3 |

| Beef | ||||

| Production | 3.8 | 6.2 | 7.1 | 4.2 |

| Consumption | 2.1 | 2.8 | 4.2 | 2.2 |

| Exports | 1.7 | 3.4 | 13.3 | 6.2 |

| Source: USDA, Economic Research Service, International Baseline Data. | ||||

Cotton Exports Projected to Remain High

Higher yields and increased profitability associated with the adoption of hybrid Bt cotton have propelled growth in cotton production and exports since 2000, and India has recently emerged as the world’s largest producer and second largest exporter. While there is still considerable potential to boost yields, low world prices associated with China’s anticipated drawdown of its large stocks are expected to affect both planted area and yields during the early part of the projection period, leading to slowed growth in production and exports over the next decade. India’s textile sector is expected to grow more slowly than it has since 2000, but still faster than in most countries, as it meets expanding domestic and export demand.

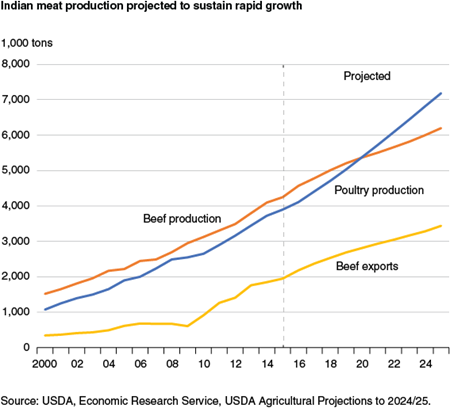

Animal Product Sectors to Play a Bigger Role

India’s poultry sector, now the world’s fifth largest, continues to expand rapidly, driven by rising incomes and relatively low production costs compared with other meats favored by Indian consumers, particularly mutton and fish. Vertical integration has increased the efficiency of poultry production and, along with competitively priced domestic supplies of corn and soybean meal, is expected to lead to continued strong growth in production and consumption.

Since the early 2000s, India’s rapidly expanding exports of water buffalo meat—or carabeef—has made it the world’s largest beef exporter, with growing sales to a broad array of primarily low- and middle-income markets. The export growth is supported by India’s large herd of water buffalo—by far the largest in the world at 109 million head—and a growing number of export-oriented slaughter facilities. Although some Indian states have recently enacted bans on the slaughter of cattle, those actions are not expected to interfere significantly with exports of carabeef, which are projected to continue to expand at more than 6 percent annually over the next decade. The recent opening of the Russian market to Indian carabeef, and ongoing negotiations to open the China market, could lead to even stronger growth.

Rapid Progress on Yields, Policy Reforms Unlikely

Current USDA long-term projections assume that Indian crop yields will continue to make little progress towards matching either world averages or domestic benchmarks. This assumption is based on historical performance; low rates of public investment in agriculture; and failure to establish a consensus policy towards the evaluation, approval, and release of genetically modified crops. Recently, the private sector has played the key role in crop productivity gains associated with the development and adoption of Bt cotton and hybrid corn, as well as the expansion of integrated poultry production. More public and private sector investment and research could spark faster gains in yields in some sectors than currently projected.

Projections also assume limited progress toward enacting and realizing impacts from reforms to subsidy and market intervention policies, which currently have their greatest impacts on the wheat and rice sectors. These assumptions are based on past performance and the complex environment for establishing consensus on significant reforms, and institutional constraints to implementation. A continuation of current progress towards replacing costly input and output price subsidies with targeted cash subsidies could lead to a shift in public resources to productive investments and facilitate a greater role for private investment in agricultural markets.

USDA Agricultural Projections to 2024, by Paul Westcott and James Hansen, USDA, Economic Research Service, February 2015

The Environment for Agricultural and Agribusiness Investment in India, by Maurice Landes, USDA, Economic Research Service, July 2008

Indian Wheat and Rice Sector Policies and the Implications of Reform, by Shikha Jha, P.V. Srinivasan, and Maurice Landes, USDA, Economic Research Service, May 2007