NAFTA at 20: With Regional Trade Liberalization Complete, Focus Shifts to Other Methods of Deepening Economic Integration

Highlights:

-

The North American Free Trade Agreement (NAFTA)—implemented in 1994 by Canada, Mexico, and the United States—has resulted in expanded flows of intraregional agricultural trade and substantial levels of foreign direct investment in the processed food sector.

-

A far more integrated North American market in grains, oilseeds, and related products and larger Mexican and Canadian shares of U.S. fruit and vegetable availability are two of NAFTA’s more prominent impacts in the agricultural sector.

-

To deepen the economic relationship fostered by NAFTA, the member countries are charting a unique course that relies more on bilateral organizational frameworks than the trilateral frameworks created by NAFTA.

More than two decades have passed since the implementation of the North American Free Trade Agreement (NAFTA) in 1994. NAFTA has had a profound effect on many aspects of North American agriculture. With a few exceptions, intraregional agricultural trade is now completely free of tariff and quota restrictions and the agricultural sectors of NAFTA’s member countries—Canada, Mexico, and the United States—have become far more integrated, as is evidenced by rising trade in a wider range of agricultural products and substantial levels of cross-border investment in the processed food sector.

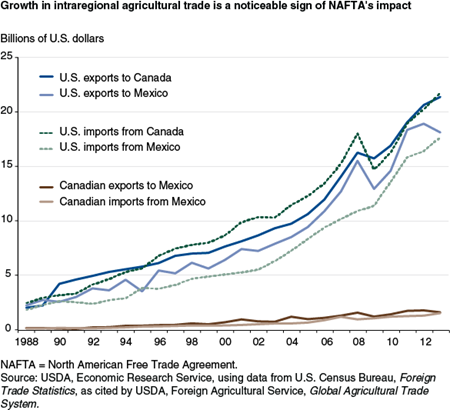

Perhaps the most obvious indicator of this increased integration is two decades of almost uninterrupted growth in intraregional agricultural trade. Between 1993 and 2013, the total value of this trade expanded from $16.7 billion to $82.0 billion, an increase of 233 percent when inflation is taken into account. Foreign direct investment (FDI) in the processed food sectors of the NAFTA countries also translates into additional sales of agricultural products. In 2012, majority-owned affiliates of U.S. multinational food companies had sales of $32.4 billion in Canada and $13.8 billion in Mexico, and majority-owned affiliates of Canadian multinational food companies had sales of $8.3 billion in the United States, according to data from the U.S. Department of Commerce’s Bureau of Economic Analysis.

A More Integrated Market in Grains, Oilseeds, and Related Products

Creation of a far more integrated North American market in grains, oilseeds, and related products is one of NAFTA’s major achievements. Prior to NAFTA, Mexico maintained strict control of corn, wheat, and barley imports via licensing requirements and provided guaranteed prices to domestic producers of many field crops. Following NAFTA’s implementation, Mexico transitioned to a system featuring duty-free trade with the United States and Canada and a mix of domestic agricultural supports similar to those in the United States. For the United States and Canada, trade liberalization of grains and oilseeds under NAFTA primarily involved the removal of minor tariffs on bilateral trade. Integration of the North American market advanced further with the recent elimination of the Canadian Wheat Board’s (CWB) authority to act as a single buyer of wheat and barley produced in in Alberta, Manitoba, Saskatchewan, or the Peace River District of British Columbia and destined for export or domestic human consumption.

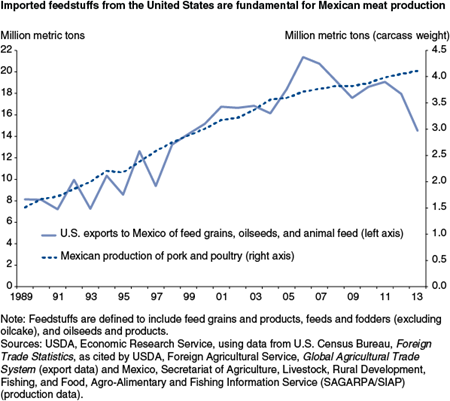

Rising demand for feed and food has created new opportunities for intraregional trade in grains and oilseeds. Poultry and hog producers in Mexico, for instance, rely heavily on imported feedstuffs as they seek to meet their country’s growing demand for meat. These imports come primarily from the United States, although Canada is a regular supplier of rapeseed and rapeseed oil to Mexico. Growing feed demand in Mexico and liberalization of U.S.-Mexico agricultural trade boosted U.S. exports to Mexico of feed grains, oilseeds, and related products from an annual average of 8.3 million metric tons during 1989-92 to 17.8 million metric tons per year during 2010-14. The years 1989-92 are used as the pre-NAFTA period for purposes of comparison because U.S. corn exports to Mexico were unusually low in 1993, the last year prior to NAFTA’s implementation. In 2013, these exports dropped to 14.5 million metric tons due to the adverse effects of the 2012 drought on U.S. grain and oilseed production. To make up for this shortfall, Mexico increased its imports of corn and soybeans from South America.

Feedstuff trade among the NAFTA countries encompasses a diversity of products in addition to traditional bulk commodities such as corn, sorghum, wheat, soybeans, rapeseed, and oilseed oils and meals. There is a substantial two-way trade between Canada and the United States in mixed feeds and mixed feed ingredients other than pet food. U.S. feedstuff exports to Mexico include preparations used for animal feeding and brewers’ and distillers’ dregs and waste. This latter category includes distillers’ dried grains with solubles (DDGS), a co-product of corn-based ethanol production that is used as an animal feed.

Imports Become More Important to U.S. Fruit and Vegetable Supply

As a result of the heightened integration of North America’s fruit and vegetable market, imports from the NAFTA countries have increased in their share of the U.S. fruit and vegetable supply. In 2012, Mexico and Canada together supplied about 15 percent of the fresh or frozen fruit available in the United States and 17 percent of the available fresh or frozen vegetables. In 1990, these shares each equaled 6 percent. Countries outside NAFTA supplied 38 percent of the available fresh or frozen fruit in 2012 and 3 percent of the available fresh or frozen vegetables. In 1990, these shares equaled 29 percent and 1 percent, respectively. Changing diets and growing off-season supplies of fresh produce outside the United States have fostered a shift in U.S. consumption away from processed fruits and vegetables and toward fresh produce. In 2012, fresh produce accounted for 50 percent of the U.S. fruit and vegetable supply (excluding juice), up from 45 percent in 1990.

Establishment of trade-facilitating phytosanitary protocols helps to ensure that produce growers are able to take advantage of the broader market opportunities afforded by NAFTA. Such protocols have enabled Mexico to become a major supplier of fresh avocados to its fellow NAFTA members. In 2014, the United States imported about 605,000 tons of fresh avocados from Mexico, valued at $1.3 billion, while Canada imported about 50,000 tons of fresh avocados from Mexico, valued at $130 million. Currently, the United States only allows the importation of Mexican fresh avocados from 24 municipalities in the State of Michoacán. In February 2015, USDA’s Animal and Plant Health Inspection Service (APHIS) released a proposed regulatory amendment that would allow growers in other Mexican States, beginning with Jalisco, to export fresh avocados to the United States, provided that individual Mexican States comply with the current systems approach for mitigating against quarantine pests of concern.

Establishment of trade-facilitating phytosanitary protocols is also important for U.S. produce growers. In May 2014, for example, Mexico’s National Service of Agro-Alimentary Health, Safety, and Quality (SENASICA) published procedural requirements that allow fresh potatoes from the United States to be exported to any part of Mexico. This issue had been the subject of negotiations by the U.S. and Mexican Governments over a 10-year period, as previous rules only allowed such products to be imported into the 16-mile zone immediately along the U.S.-Mexico border. Several weeks after the new procedural requirements took effect, however, a Mexican District Court Judge in Los Mochis, Sinaloa, issued an injunction that indefinitely suspended their implementation—a ruling that was based on a perceived lack of scientific evidence regarding the safety of U.S. potatoes with respect to the possible introduction of pests to Mexican agriculture and the environment.

No Blueprint for Future Integration

NAFTA contains no blueprint for deepening regional integration after full implementation of the agreement’s trade-liberalizing provisions and other requirements. Unlike the member countries of the European Union (EU), the NAFTA countries so far have not elected to transition toward a customs union—a free-trade area in which the member countries share a set of common external tariffs (CETs)—and then a common market—a customs union with the additional features of free movement of labor and capital. These stages of integration were outlined by the late economist Bela Balassa over 50 years ago. Nor have the NAFTA countries followed the counsel of the late international affairs specialist Robert Pastor, who advocated the creation of a trinational advisory commission to offer policy suggestions on regional economic integration and a permanent trade and investment court to adjudicate trade disputes, in place of the ad hoc panels created in accordance with NAFTA’s dispute resolution procedures. Instead, the NAFTA governments are taking actions that increase the fluidity of cross-border economic activity without modifying the text of NAFTA or the free-trade area that the agreement creates. For the agricultural sector, perhaps the most important efforts of this type concern regulatory cooperation. In addition, U.S. decisionmakers have considered changes to U.S. immigration laws that would more tightly integrate the U.S. and Mexican markets for hired farm labor.

From Regulatory Coordination to Regulatory Cooperation

Activities in the area of regulatory cooperation provide a clear example of the current North American approach toward deeper integration. The term “regulatory cooperation” has largely replaced “regulatory coordination” as a descriptor of these efforts. This change reflects the NAFTA governments’ emphasis on building national regulatory systems that fit together and facilitate trade, rather than simply making adjustments to existing regulatory systems so that they do not unnecessarily impede trade.

A Single Window Environment is one of the key regulatory systems along these lines. A Single Window Environment, as defined by the World Customs Organization, is a “cross-border, ‘intelligent,’ facility that allows parties involved in trade and transport to lodge standardized information, mainly electronic, with a single entry point to fulfill all import, export, and transit-related regulatory requirements.” The Mexican Single Window for Foreign Trade (VUCEM) has been operational since 2012 and continues to undergo further refinements; the U.S. single window, formally known as the Automated Commercial Environment (ACE), is scheduled to go into operation by the end of 2016; and key elements of Canada’s Single Window Initiative (SWI) are scheduled to go online later in 2015.

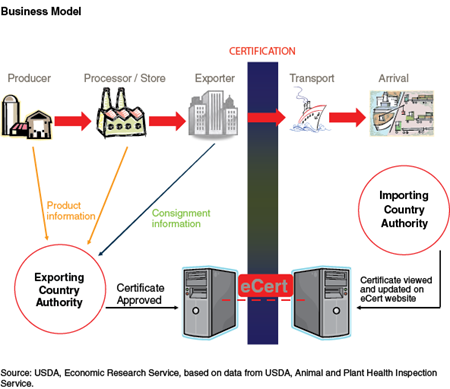

Specific to agriculture, the U.S. and Mexican Governments are working to develop compatible electronic export and import certificate programs (“E-certificates”) for plants and plant products and eventually for animals and animal products. Similar efforts to develop E-certificates are being undertaken by the U.S. and Canadian Governments. In general, phytosanitary and sanitary certificates are issued to indicate that consignments of plants, plant products, animals, animal products, or other regulated articles meet specified phytosanitary or sanitary requirements. The United States already receives phytosanitary E-certificates transmitted by the Governments of Australia, New Zealand, and the Netherlands. Single Window Environments would then provide another mechanism for the sharing or referencing of sanitary and phytosanitary E-certificates.

During NAFTA’s first decade and a half, regulatory cooperation among the member countries was often achieved through trilateral arrangements. Over the past half-decade, however, such cooperation has become more reliant on bilateral organizational frameworks. NAFTA established an extensive set of trilateral working groups and committees responsible for a wide variety of trade-related issues, such as the Committee on Sanitary and Phytosanitary Measures. From 2005 to 2009, the NAFTA governments channeled some efforts in regulatory cooperation through the Security and Prosperity Partnership (SPP), a trilateral framework created at the highest levels of government that was intended to increase the security and enhance the prosperity of the NAFTA countries through greater cooperation and information sharing.

| Selected bilateral framework | Information |

|---|---|

| Consultative Committees on Agriculture (CCAs) | Bilateral meetings of high-level agricultural and trade officials of national governments where agricultural trade issues of mutual interest are discussed, including bilateral concerns and sometimes issues involving third-country markets. Meetings of this type with non-NAFTA countries also take place. |

| U.S.-Canada CCA | First meeting: September 1999. Most recent meeting: December 2014. |

| U.S.-Mexico CCA | First meeting: October 2002. Most recent meeting: December 2014. |

| Canada-Mexico CCA | First meeting: March 2003. Most recent meeting: August 2012. |

| U.S.-Mexico High-Level Regulatory Cooperation Council (HLRCC) | Group charged with improving regulatory cooperation between the two countries; consists of senior-level regulatory, trade, and foreign affairs officials from each country. Launched in May 2010. Work Plan contains two items directly related to agricultural trade and food. |

| U.S.-Canada Beyond the Border Initiative (BtB) | Long-term partnership focused on mutual security and economic competitiveness. Launched in February 2011. Trade facilitation, economic growth, and jobs form one area of cooperation. Action Plan contains about 14 items directly or potentially related to agricultural trade and food. |

| U.S.-Canada Regulatory Cooperation Council (RCC) | Effort to improve alignment of national regulatory systems and boost trade and North American competitiveness. Launched in February 2011. Action Plan contains about 10 items directly or potentially related to agricultural trade and food. |

| Selected NAFTA Committees and Working Groups related to agriculture (article in NAFTA that created committee or working group listed in parentheses) | |

| NAFTA Committee on Sanitary and Phytosanitary Measures (Article 722) | Responsible for: facilitating enhancement of food safety and improvement of sanitary and phytosanitary (SPS) conditions in NAFTA countries; activities of member countries regarding international standards and standardizing organizations and equivalence; technical cooperation between member countries, including the development, application and enforcement of SPS measures; and consultations on specific matters relating to SPS measures. Had nine working groups at one point. Meets in response to request from any NAFTA government. Most recent meeting: July 2012. |

| NAFTA Technical Working Group (TWG) for Meat, Poultry, and Egg Products | Led to creation of Fruit and Vegetable Dispute Resolution Corporation (DRC) in February 2000. DRC closed its Mexico offices in 2007 due to limited participation by Mexican buyers but continues its work from its Ottawa headquarters. Efforts to develop comparable approaches to financial risk mitigation tools to protect U.S. and Canadian fruit and vegetable suppliers from buyers that default on their payment obligations continue within U.S.-Canada RCC. |

| Other selected trilateral frameworks | |

| North American Plant Protection Organization (NAPPO) | A forum in which public and private sectors of Canada, Mexico, and the United States collaborate in the regional protection of agricultural, forest, other plant resources, and the environment while facilitating trade. Founded: 1976. Most recent meeting: October 2014. |

| North American Tripartite Committee on Agricultural Statistics (NATCAS) | Agricultural statistics agencies of NAFTA governments meet to discuss concerns regarding data collection, methodology. Some joint publication of statistics. Launched May 2006. |

| Security and Prosperity Partnership (SPP) | Trilateral initiative involving the highest levels of the NAFTA governments that aimed to improve the security and enhance the prosperity of the NAFTA countries. Launched: 2005; ended: 2009. Five working groups, including one on food and agriculture. |

| Source: Unofficial compilation by USDA, Economic Research Service. | |

Many concrete accomplishments in regulatory cooperation involving the NAFTA countries over the past 21 years were the product of trilateral efforts. These include the coordinated campaign by all three countries to seek a harmonized approach to mitigating the risks associated with bovine spongiform encephalopathy and the expanded practice of sharing scientific studies and administrative evaluations among pesticide regulators and scientists in each NAFTA country.

But regulatory cooperation also took place within bilateral organizational frameworks, such as the intergovernmental Consultative Committees on Agriculture (CCAs), or through collaboration between governments at the working level. The CCAs provide a setting in which high-level officials of the NAFTA governments meet on a bilateral basis to discuss issues related to agricultural trade. The CCAs most recently met in December 2014 (U.S.-Canada and U.S.-Mexico) and August 2012 (Canada-Mexico).

While many of NAFTA’s working groups and committees are still in operation, the trilateral SPP has been succeeded by several new bilateral frameworks: the U.S.-Mexico High Level Regulatory Cooperation Council (HLRCC), established in 2010, and the U.S.-Canada Beyond the Border (BtB) initiative and the U.S.-Canada Regulatory Cooperation Council (RCC), both established in 2011. Like the SPP, the BtB addresses mutual concerns in the areas of security and economic competitiveness, except on a bilateral (U.S.-Canada) rather than trilateral basis. By contrast, the HLRCC and RCC focus exclusively on regulatory concerns, both agricultural and nonagricultural. Relying more on bilateral frameworks is consistent with the long-standing recognition that some issues pertain to only two of the three NAFTA countries and that the regulatory priorities and capabilities of the NAFTA governments differ in ways that make it easier to cooperate on a bilateral basis.

Two key principles stand out in the three bilateral frameworks. First, each country is viewed as a major stakeholder in the regulatory systems of the other country. This recognition is central, for instance, to the HLRCC’s objective of intensifying the dialogue between Mexico and the United States regarding the implementation of the U.S. FDA Food Safety and Modernization Act (FSMA). To this end, Mexico’s Secretariat of Economy and the FDA’s Latin America Regional Office in Mexico held four informational workshops on FSMA in 2013, each in a different part of Mexico. In addition, the FDA’s regional office conducted outreach activities on two proposed FSMA rules: the Produce Rule and the Preventive Controls for Food for Humans. These activities included guidance on how to offer comments on the proposed rules and how to receive further information on forthcoming FSMA implementing regulations.

Second, the new frameworks emphasize regulatory simplification. Several initiatives within the U.S.-Canada RCC, for instance, aim to reduce or eliminate certain inspection activities and administrative procedures concerning food safety. As a step toward streamlining bilateral trade in meat and poultry products, the U.S. and Canadian Governments are working to identify options for simplifying or eliminating import certificates, have created common nomenclatures for meat cuts, and are taking steps to ensure that “food safety laboratory testing conducted in one country is acceptable to regulators in both countries.” The objective of regulatory simplification is also woven within several key principles of the U.S.-Mexico HLRCC’s work plan.

A Uniquely North American Course

Few trade agreements other than NAFTA have created a free-trade area that encompasses an economy as large as that formed by the United States, Canada, and Mexico and institutes tariff- and quota-free intraregional trade for virtually all agricultural products. The one major exception to this pattern is the European Union, whose member countries deliberately made the transition from a free-trade area to a common market. Current efforts by the NAFTA countries to deepen their regional integration via regulatory cooperation build upon and enhance the functioning of the free-trade area created by NAFTA without relying on specific policy directives in the agreement, thereby taking the NAFTA countries deeper into uncharted territories of regional integration and heightened policy coordination.

NAFTA at 20: North America's Free-Trade Area and Its Impact on Agriculture, by Steven Zahniser, Sahar Angadjivand, Thomas Hertz, Lindsay Kuberka, and Alexandra Santos, USDA, Economic Research Service, February 2015

North American Agricultural Trade Policy: Are Super-Regionalism and Deeper Regional Integration the “Next Big Thing” after NAFTA?, by Steven Zahniser and Adriana Herrera Moreno, Estey Centre Journal of International Law and Trade Policy, September 2014