Rising Concentration in Agricultural Input Industries Influences New Farm Technologies

Highlights:

-

Concentration in several global agricultural input industries has risen significantly; by 2009, the largest four firms in the crop seed, agricultural chemical, animal health, animal genetics/breeding, and farm machinery sectors accounted for more than 50 percent of global market sales in each sector.

-

Factors influencing changes in market structure and concentration vary by industry and include market forces, the emergence of new technologies, and government policies.

-

The largest agricultural input firms are responsible for a large and growing share of global agricultural research and development (R&D), and higher input prices paid by farmers partially reflect the higher quality of inputs created through private-sector R&D.

The increase in R&D performed by global agricultural input industries (see 'Private Industry Investing Heavily, and Globally, in Research To Improve Agricultural Productivity' in the June 2012 issue of Amber Waves) has coincided with significant changes to the structure of these industries. The largest firms have increased their market shares and account for most of the investment in (and ownership of) new innovations in these industries. Implications of market concentration in the U.S. seed industry were addressed earlier in Amber Waves and in other ERS research (see suggested readings). New ERS data allow a closer look into global market concentration across a number of agricultural input industries.

Market Concentration is Increasing in Research-Intensive Agricultural Input Industries

Since the 1990s, global market concentration (the share of global industry sales earned by the largest firms) has increased in the crop seed/biotechnology, agricultural chemical, animal health, animal breeding, and farm machinery industries - all of which invest heavily in agricultural research. By 2009, the largest four firms in each of these industries accounted for at least 50 percent of global market sales. Market concentration was particularly high in animal genetics and breeding, where the four-firm concentration ratio reached 56 percent in 2006/07 (the latest year for which data are available). Growth in global market concentration over 1994-2009 was most rapid in the crop seed industry, where the market share of the four largest firms more than doubled from 21 to 54 percent. The top eight firms in all five input sectors had between a 61- and 75-percent share of global market sales by 2009.

Factors Driving Market Concentration Vary by Industry

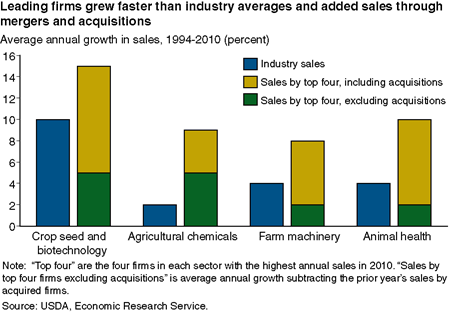

Firms increase their market share either by expanding their sales faster than the industry average or by acquiring or merging with other firms in the industry. Firms can expand their sales faster than others in the industry by offering better products or services (often an outgrowth of larger R&D investments), improving their marketing ability, or offering lower prices (often through economies of scale). The leading input firms in 2010 had faster sales growth than the industry average, but a significant amount of that growth came from acquisitions of other firms.

| Year | Four-firm concentration ratio | Eight-firm concentration ratio | |

|---|---|---|---|

| Crop seed and biotechnology | 1994 | 21.1 | 29.0 |

| 2000 | 32.5 | 43.1 | |

| 2009 | 53.9 | 63.4 | |

| Agricultural chemicals | 1994 | 28.5 | 50.1 |

| 2000 | 41.0 | 62.6 | |

| 2009 | 53.0 | 74.8 | |

| Farm machinery | 1994 | 28.1 | 40.9 |

| 2000 | 32.8 | 44.7 | |

| 2009 | 50.1 | 61.4 | |

| Animal health | 1994 | 32.4 | 57.4 |

| 2000 | 41.8 | 67.4 | |

| 2009 | 50.6 | 72.0 | |

| Animal genetics | 1994 | na | na |

| 2000 | na | na | |

| 2009 | 55.9 | ||

| na = data not available. The concentration ratio measures the share of global market sales earned by the largest four or eight companies in the sector. Source: USDA, Economic Research Service estimates from Fuglie et al. (2011). |

|||

Reasons for mergers and acquisitions vary by industry and firm circumstances but include market forces and the emergence of new technologies. Government policies can also affect the ability of firms to compete in markets and their incentives to merge with or acquire other firms.

- In the crop seed and animal breeding sectors, the emergence of biotechnology was a major driver of consolidation. Companies sought to acquire relevant technological capacities and serve larger markets to share the large fixed costs associated with meeting regulatory approval for new biotechnology innovations.

- In the animal breeding sector, vertical integration in the poultry and livestock industries enabled some large firms to acquire capacity in animal breeding as part of their integrated structure.

- In the farm machinery industry, many of the major mergers and acquisitions can be traced to large financial losses sustained by some leading firms during periods when the farm sector was in prolonged recession, which substantially reduced demand for farm machinery as farmers delayed major capital purchases. Firms experiencing large financial losses are often vulnerable to acquisition.

- The agricultural chemical sector has been heavily affected by changes in government regulations governing the health, safety, and environmental impacts of new and existing pesticide formulations: larger firms appear better able to address these stricter regulatory requirements.

- Consolidation in the animal health sector appears to be largely a byproduct of mergers and acquisitions in the pharmaceutical industry, as most of the leading animal health companies are subsidiaries of large pharmaceutical companies.

| Farm input sector | Factors driving consolidation and concentration |

|---|---|

| Crop seed and biotechnology | Acquisition of complementary technology and marketing assets, economies of scale in crop biotechnology research and development |

| Agricultural chemicals | Stricter environmental and safety regulations; maturing markets; rise of generic products |

| Farm machinery | Financial losses of major manufacturers during farm sector business cycles (which strongly influence demand for large capital purchases) |

| Animal breeding and genetics | Vertical integration of poultry and livestock industries; economies of scale in animal biotechnology R&D |

| Animal health | Spillover from consolidation in the human pharmaceutical industry, which is being driven by loss of profit streams and idled capacity when major drugs go off-patent |

| na = data not available. The concentration ratio measures the share of global market sales earned by the largest four or eight companies in the sector. Source: USDA, Economic Research Service estimates from Fuglie et al. (2011). |

|

The Crop Seed-Biotechnology Industry Has Undergone Significant Structural Transformation

In 2009, seven large seed companies each had annual seed sales of over $600 million. Five of these top seed companies--Syngenta, Bayer, Dow, Dupont, and Monsanto--are also market leaders in agricultural chemicals. A sixth firm, BASF, is making significant investments in crop biotechnology research but so far reports few crop seed or trait sales, although it is a market leader in agricultural chemicals. These companies currently constitute the 'Big 6' involved in crop seed, biotechnology, and chemical research.

The seed-biotechnology industry has been reliant on small and medium-sized enterprises (SMEs) as sources of new innovation. New SME startups (often spinoffs from university research) tend to specialize in commercial development of a new research tool, genetic trait, or both. Significant entry by SMEs into the seed-biotechnology sector began in the late 1970s and early 1980s, with a second wave of new entrants in the late 1990s and early 2000s. In recent years, exits have outnumbered entrants, and by 2008 just over 30 SMEs specializing in crop biotechnology were still active. The majority of the exits from the industry were the result of acquisition by larger firms. Of 27 crop biotechnology SMEs that were acquired between 1985 and 2009, 20 were acquired either directly by one of the Big 6 or by a company that itself was eventually acquired by a Big 6 company.

Concentration in a research-intensive industry can be measured not only in terms of share of product sales but in share of new innovations. Firms that are most successful in creating new innovations are often better positioned to dominate the market (although not all new product introductions will be commercially successful). In research for genetically engineered crop varieties, for example, companies typically obtain a patent first, then initiate field trials, and finally obtain regulatory approval to sell crop seeds. Although there is considerable overlap in terms of companies participating, the markets for crop seeds can be distinguished from markets for genetically modified traits. The shares of these research outputs held by the Big 6 companies in each case are between 55 and 95 percent.

| Measure of research output or new product commercialization | Share held by Big 6 companies (including subsidiaries and acquisitions |

|---|---|

| U.S. patents issued for all crop cultivars, 1982 to 2007 | 76 |

| U.S. patents issued for agricultural biotechnology, 1976 to 2000 | 64 |

| Field trials of genetically modified (GM) plants in the U.S., 1985 to mid-2008 | 62 |

| GM crop approvals for planting or environmental release globally, 1985 to 2007 | 87 |

| Market share for U.S. corn seed, 2007 | 70 |

| Market share for U.S. soybean seed, 2007 | 55 |

| Market share for U.S. cotton seed, 2007 | 92 |

| Market share of trait-acres* for GM corn, soybeans, cotton, and canola worldwide in 2007 | >95 |

| Market share of trait-acres* for GM corn, soybeans, and cotton in the U.S. in 2009 | >95 (90% held by top firm) |

| na = data not available. The concentration ratio measures the share of global market sales earned by the largest four or eight companies in the sector. Source: USDA, Economic Research Service estimates from Fuglie et al. (2011). |

|

Consequences of Concentration For Agricultural Innovation

The rising concentration in global agricultural input markets means fewer firms are supplying those inputs to farmers. It also means that fewer firms are responsible for many of the new innovations that drive growth in agricultural productivity. The share of private R&D performed by the largest firms is even larger than their share of sales. In crop seed and biotechnology, eight seed-biotechnology companies accounted for 76 percent of all R&D spending by this industry in 2010. In agricultural chemicals, five companies (each with over $2 billion sales in 2010) were responsible for over 74 percent of the R&D in this sector. In farm machinery, four companies (each with over $5 billion in farm machinery sales) accounted for over 57 percent of farm machinery R&D, and in animal health, just eight companies accounted for over 66 percent of R&D. Moreover, all of these leading firms are multinational companies with R&D facilities positioned around the world. These global research networks allow large firms to develop and adapt new technologies to local conditions, meet national regulatory requirements for new product introductions, and achieve cost economies in some of their R&D activities.

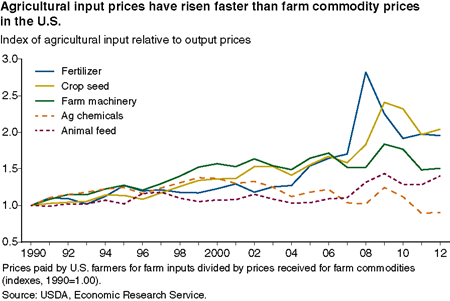

Greater market power resulting from the structural changes in agricultural input industries means that farmers may pay higher prices for purchased inputs. With stronger legal protection over their intellectual property and fewer firms offering competition, firms can charge higher prices for their new innovations. Such price premiums are necessary to provide firms the means (and incentive) to invest in R&D in the first place, and farmers are willing to pay higher prices so long as the gains from higher productivity outweigh their higher costs. In fact, for the past two decades, the prices of farm inputs have been rising faster than the prices U.S. farmers receive for their crops and livestock.

The largest increase over 1990-2010 was in crop seed prices, which more than doubled relative to the price received for agricultural commodities. This increase was due, at least in part, to the value of the new seed traits resulting from research investments made by seed/biotechnology companies. However, higher input prices may also stem from increases in the prices of labor, capital, energy, and other materials used in their manufacture. The sharp rise in the price of fertilizer in 2008-09 was driven by a significant increase in the cost of energy and materials used to make fertilizers, higher transportation costs, and the falling value of the U.S. dollar. Multiple factors contribute to changing prices for farm inputs, and it is difficult to isolate the effects of market power, product quality, and other factors affecting these prices.

The growing concentration in agricultural input industries raises a number of issues. One is the inherent tension between public policies regulating intellectual property rights (IPR) and market competition. While antitrust laws restrict firms from exercising monopoly power, some exceptions are made for intellectual property rights over new innovations. However, antitrust rules may still apply to how firms license their intellectual property to other firms. Another issue is whether under the current market and policy environment there are significant economies of scale in crop and animal biotechnology, implying that only very large firms can hope to compete effectively in these sectors. This might mean there is a significant barrier to entry for new firms and a potential loss of new innovations, particularly from SMEs. On the other hand, the global reach of the large, multinational agricultural input firms could speed up the rate of international technology transfer and help to close the productivity gaps between regions and countries. The rate of transfer will be influenced by international trade agreements and how countries regulate and protect IPR in new agricultural innovations, especially those involving genetically modified organisms. Finally, public investments in research can be an important enabler of market competition. Examples include public provision of elite parent material for crop/livestock breeding companies and the basic scientific tools necessary for commercial development using genomics and molecular biology.

Research Investments and Market Structure in the Food Processing, Agricultural Input, and Biofuel Industries Worldwide, by Keith Fuglie, Paul Heisey, John King, Carl E. Pray, Kelly Day Rubenstein, David Schimmelpfennig, Sun Ling Wang, and Rupa Karmarkar-Deshmukh, USDA, Economic Research Service, December 2011

Concentration and Technology in Agricultural Input Industries, by John King, USDA, Economic Research Service, March 2001

'Have Seed Industry Changes Affected Research Effort?', Amber Waves, February 2004, Vol. 2, Issue 1.

'The Impact of Seed Industry Concentration on Innovation: A Study of U.S. Biotech Market Leaders', Agricultural Economics, March 2004, Vol. 30, No. 2, pp. 157-67.

'Competition Issues in the Seed Industry and the Role of Intellectual Property', Choices, February 2010, Vol. 25, No. 2.