Ethanol Reshapes the Corn Market

Highlights:

-

Work is underway to add over 2 billion gallons to the annual capacity of the U.S. ethanol sector.

-

To meet the sector’s growing demand for corn, some U.S. corn is likely to be diverted from exports.

-

In the future, corn may cease to be the main feedstock for U.S. ethanol production if cellulosic biomass is successfully developed as an alternative.

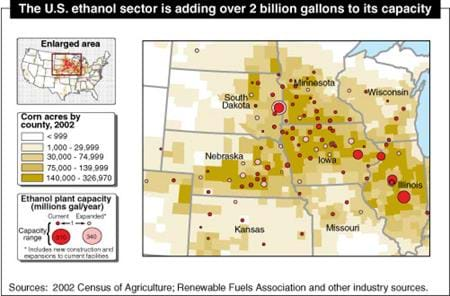

The year 2005 was marked by a flurry of construction activity in the Nation’s ethanol industry, as ground was broken on dozens of new plants throughout the U.S. Corn Belt and plans were drawn for even more facilities. As of February 2006, the annual capacity of the U.S. ethanol sector stood at 4.4 billion gallons, and plants under construction or expansion are likely to add another 2.1 billion gallons to this number (map). If this trend and the existing and anticipated policy incentives in support of ethanol continue, U.S. ethanol production could reach 7 billion gallons in 2010, 3.3 billion more than the amount produced in 2005.

The tremendous expansion of the ethanol sector raises a key question: Where will ethanol producers get the corn needed to increase their output? With a corn-to-ethanol conversion rate of 2.7 gallons per bushel (a rate that many state-of-the-art facilities are already surpassing), the U.S. ethanol sector will need 2.6 billion bushels per year by 2010—1.2 billion bushels more than it consumed in 2005. That’s a lot of corn, and how the market adapts to this increased demand is likely to be one of the major developments of the early 21st century in U.S. agriculture. The most recent USDA Baseline Projections suggest that much of the additional corn needed for ethanol production will be diverted from exports. However, if the United States successfully develops cellulosic biomass (wood fibers and crop residue) as an economical alternative feedstock for ethanol production, corn would become one of many crops and plant-based materials used to produce ethanol (see “That 70s Energy Scene”).

Where Will the Corn Come From?

Large corn stocks will enable U.S. ethanol production to increase initially without requiring much additional adjustment in the corn market. The U.S. ended the 2004/05 marketing year (MY—September 2004-August 2005) with stocks of 2.1 billion bushels—enough to produce 5.7 billion gallons of ethanol. As long as corn is the primary feedstock for ethanol in the U.S., however, sustained increases in ethanol production will eventually require adjustments in the corn market.

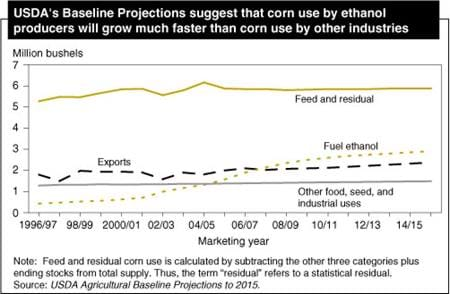

One possibility is that ethanol producers will secure the additional corn they need by competing with other buyers in the marketplace and bidding up the price of corn. According to the USDA Agricultural Baseline Projections (released in February 2006), the share of ethanol in total corn use will rise from 12 percent in 2004/05 to 23 percent in 2014/15. A comparison of the 2006 Baseline with the 2005 Baseline suggests that much of the increased use by ethanol producers will be diverted from potential exports; the 2006 Baseline projects higher use for ethanol and lower exports than the 2005 Baseline.

If demand for ethanol reduces the availability of U.S. corn for export, one might ask how this will alter the geographical composition of U.S. exports. The 2006 Baseline suggests that among the major foreign buyers of U.S. corn, Japan and Taiwan are likely to be the least responsive to a rise in corn prices, while Canada, Egypt, and the Central American and Caribbean region are likely to be the most responsive. Japan and Taiwan both have relatively high per capita incomes and limited corn production. In contrast, Canada, another high-income country, has substantial levels of corn production and could respond to higher prices with increased output of corn, wheat, and other feed grains. Per capita income in Egypt, Central America, and the Caribbean is relatively low, and higher prices may drive these countries to cut back in corn use, increase domestic corn production, or seek out substitutes. Egypt already produces a sizable amount of corn.

Slower growth of U.S. corn exports would create new opportunities for corn producers in other parts of the world, including Argentina, Brazil, and China. Another country to watch is Mexico, where irrigated lands have accounted for about half of the increase in domestic corn production since the late 1980s. Much of this increase has taken place in the State of Sinaloa, where farmers are applying advanced agricultural techniques to obtain yields comparable to those in the United States. Sinaloa, however, is relatively distant from corn-deficit areas in Mexico, and many of these producers have counted on marketing subsidies to offset some of the transportation costs. Increased demand for corn by U.S. ethanol producers might push prices high enough that these transportation costs are more easily surmounted.

Farmers May Increase Corn Supply

The growing corn demand of ethanol producers could also be satisfied through higher corn output. Rising productivity is likely to assure some increase in U.S. corn production in the years to come, even if the amount of farmland devoted to corn remains constant. Over the past decade (1996-2005), U.S. corn yields averaged 138 bushels per acre, compared with 115 bushels during the previous decade. The United States also could increase corn production by devoting more land to the commodity. Such an effort would probably draw upon lands less suited to corn production. Much of these lands would probably be diverted from soybean production.

Growing corn more intensively is yet another approach. For instance, some producers who currently pursue a corn-soybean rotation (planting corn one year and soybeans the next) might shift to a corn-corn-soybean rotation (planting corn 2 years in a row and then planting soybeans in the third). Continuous production of corn (planting corn every year on the same plot of land) is another possibility. Interestingly, one of the key factors boosting ethanol demand—high oil prices—also makes intensive corn production less attractive because more fertilizer would be needed.

One way to get more ethanol feedstock out of existing levels of corn production is to use the stalk, leaves, and cobs left over after harvest—materials that are formally known as stover. An acre of corn will yield roughly 5,500 dry pounds of stover, enough to produce about 180 gallons of ethanol. In the United States, corn stover is typically left in the field following harvest to minimize erosion and to contribute organic matter to the soil, so removing some of the stover at harvest might adversely affect the long-term viability of the soil.

Market Adjustments Extend to Ethanol Co-Products and Beyond

As ethanol production increases, the supply of ethanol co-products will also increase. Both the dry-milling and wet-milling methods of producing ethanol generate a variety of economically valuable co-products, the most prominent of which is perhaps distiller’s dried grains with solubles (DDGS), which can be used as a feed ingredient for livestock. Each 56-pound bushel of corn used in dry mill ethanol production generates about 17.4 pounds of DDGS. In the United States, cattle (both dairy and beef) have so far been the primary users of DDGS as livestock feed, but larger quantities of DDGS are making their way into the feed rations of hogs and poultry. Use of distiller’s grains in animal production lowers the use of corn and protein supplements (see “Emergence of DDGS Market Creates New Needs for Data”).

The marketing of ethanol co-products is just one way in which ethanol producers are making their operations more profitable. Another way is to save energy by locating ethanol plants in close proximity to dairy or livestock production. Specifically, a dairy or livestock producer is able to lower the transport costs associated with feed acquisition by establishing a nearby facility to manufacture ethanol and distiller’s grains. The latter may be quickly transported to feed nearby livestock without needing to be dried, and the manure generated by the livestock can be used to produce heat or electricity for the ethanol plant, but this entails a sizable capital cost.

Closer integration of ethanol production with other agri-industrial activities is likely to displace some traditional marketing and distribution channels for corn. Indeed, the services of some grain elevators may no longer be needed in some areas if local corn supplies are used in their entirety for ethanol production. The transportation sector may be the site of several noteworthy adjustments, as the profitability of the expanded ethanol sector will depend on economical methods of handling the growing supply of ethanol and its co-products, as well as the feedstock necessary to produce them. Some large-scale ethanol plants may find it cost effective to receive corn deliveries by rail on specially constructed trunk lines, while others may rely on truck, barge, or existing rail lines, depending on the location of the facility. The transportation of ethanol requires special attention. Ethanol is usually not moved across large distances by pipeline because the product has the ability to absorb the water and impurities commonly found in pipelines. Instead, the product is customarily shipped in tanks by train, truck, or barge, and then mixed directly with gasoline in the tanker trucks that deliver fuel to gas stations.

New Feedstocks Are the Wild Card

The search for ethanol feedstocks will not stop at the edge of the corn field. While corn is currently the primary feedstock for U.S. ethanol production, many other agricultural commodities and plant-generated materials can be used to produce the fuel. For example, ethanol derived from sugar cane satisfies roughly half of Brazil’s annual demand for motor vehicle fuel, and sorghum is the feedstock for about 3 percent of U.S. ethanol production.

The U.S. and many other countries are very interested in cellulosic biomass as a potential feedstock for ethanol. Cellulosic biomass refers to a wide variety of plentiful materials obtained from plants—including certain forest-related resources (mill residues, precommercial thinnings, slash, and brush), many types of solid wood waste materials, and certain agricultural wastes (including corn stover)—as well as plants that are specifically grown as fuel for generating electricity. A report prepared for the U.S. Department of Energy and USDA in 2005 suggests that, by the middle of the 21st century, the United States should be able to produce 1.3 billion dry tons of biomass feedstock per year—enough to displace at least 30 percent of its current petroleum consumption.

Harnessing cellulosic biomass to produce ethanol will require the development of economically viable technologies that can break the cellulose into the sugars that are distilled to produce ethanol. No one knows for sure how long it will take to develop these technologies, although the more optimistic predictions are in the neighborhood of 5-10 years. To expedite the achievement of this goal, the Energy Policy Act of 2005 directs incentives specifically toward the use of cellulosic biomass as a feedstock for renewable fuel. For the purpose of meeting the Renewable Fuel Standard, 1 gallon of cellulosic biomass ethanol is treated as 2.5 gallons of renewable fuel through the end of 2012. The Act also provides for research, development, and demonstration projects concerning cellulosic biomass, and it mandates that at least 250 million gallons of renewable fuel be produced per year using cellulosic biomass, beginning in 2013. Until cellulosic biomass is successfully commercialized, however, corn will almost certainly remain the primary feedstock for U.S. ethanol production.

<a name='box1'></a>That 70s Energy Scene

The factors behind ethanol’s resurgence are eerily reminiscent of the 1970s and early 1980s, when interest in ethanol rebounded after a long period of dormancy. First, the price of crude oil has risen to its highest real level in over 20 years, averaging more than $50 per barrel in 2005. Long-term projections from the U.S. Department of Energy’s Energy Information Administration (EIA) suggest that the price of imported low-sulfur light crude oil will exceed $46 per barrel (in 2004 prices) throughout the period 2006-30 and will approach $57 per barrel toward the end of this period. It is important to remember, however, that as the price of oil dropped during the first half of the 1980s, so, too, did ethanol’s profitability.

Second, many refineries are replacing methyl tertiary butyl ether (MTBE) with ethanol as an ingredient in gasoline. Oxygenates such as MTBE and ethanol help gasoline to burn more thoroughly, thereby reducing tailpipe emissions, and were mandated in several areas to meet clean air requirements. But many State governments have recently banned or restricted the use of MTBE after the chemical was detected in ground and surface water at numerous sites across the country. In the 1970s and 1980s, a similar phaseout ended the use of lead as a gasoline additive in the United States. Both ethanol and lead raise the octane level of gasoline, so the lead phaseout also fostered greater use of ethanol.

Third, the Energy Policy Act of 2005 specifies a new Renewable Fuel Standard (RFS) that will ensure that gasoline marketed in the United States contains a specific minimum amount of renewable fuel. Between 2006 and 2012, the RFS is slated to rise from 4.0 to 7.5 billion gallons per year. Assessments of the existing and likely future capacity of the U.S. ethanol industry indicate that the RFS will easily be achieved. The RFS joins a long list of incentives that the State and Federal governments have directed toward ethanol since the 1970s. One of the most important of these incentives is the Federal tax credit, initiated in 1978, to refiners and marketers of gasoline containing ethanol. The credit, which may be applied either to the Federal sales tax on the fuel or to the corporate income tax of the refiner or marketer, currently equals 51 cents per gallon of ethanol used.

<a name='box2'></a>Emergence of DDGS Market Creates New Needs for Data

The growing supply of DDGS has spurred demand for detailed market information about this commodity, comparable to what exists for other feedstuffs. USDA’s Agricultural Marketing Service (AMS) already collects and disseminates some information about this fledgling market. The Corn Belt Feedstuffs weekly out of St. Josephs, Missouri, provides DDGS price information for a number of regional markets. USDA and the Wisconsin Department of Agriculture provide a weekly report containing different DDGS price quotes for Wisconsin and Eastern Minnesota based on different moisture levels of the product. And in February, AMS unveiled a new Illinois report for the eastern Corn Belt that includes data about the DDGS market.

Feed Outlook, USDA, Economic Research Service, November 2005, FDS-05j.

USDA Agricultural Baseline Projections to 2015, by Paul Westcott, USDA, Economic Research Service, February 2006

Corn and Other Feed Grains, by Aaron M. Ates, USDA, Economic Research Service, December 2023

Feed Grains Database, by Aaron M. Ates, USDA, Economic Research Service, April 2024